We work with a wide variety

of insurance providers

and 100+ more

with you in advance. Questions? Contact us to confirm if your insurance is accepted.

We will work with you to help reduce the stress surrounding insurances

Say goodbye to insurance headaches! Our dedicated team handles the complexities with our “No Stress Promise,” guiding you every step of your treatment journey.

Step 1: We contact

your insurance for you

Just give us your insurance info, and we take over! Our team directly contacts your insurer to verify coverage, handle pre-authorizations, and manage all the paperwork for you.

Step 2: Understanding

your coverage, together

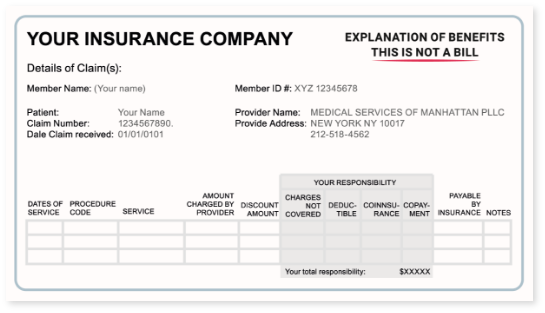

Important paperwork you need to bring

Confusing info from your insurer?

If you hear or receive paperwork from your insurance company that sounds confusing or unexpected, please contact us immediately! We’re here to help clarify and advocate for you. 844-690-1788

Explanation of benefits (Not a bill)

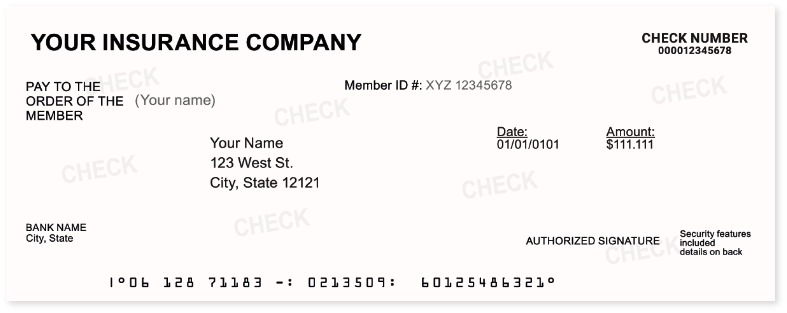

Checks if you receive any!

If your insurance does cover your treatment, here’s what to expect

This means your insurance company identifies it as medically necessary, so our team will smoothly guide you on the path to healthier legs.

Making sense of your insurance plan

Insurance terms can be confusing, but we’ll simplify them! We’ll explain your specific plan’s details for common terms like:

Your cost/expense

Deductible: The amount you pay for covered services before your plan pays. We’ll clarify yours.

1

Coinsurance: Your percentage share for covered services after your deductible. Ex: 70/30. We’ll detail this for you.

2

Out-of-Pocket Maximum: The most you’ll pay for covered services in a year. After reaching this, your plan pays 100%.

Copay: A fixed fee for certain covered services. We’ll explain if this applies to you.

We understand each patient case is unique, so let’s review your insurance status together.

Contact our team

Explore more payment options

If your plan has limitations or doesn’t fully cover your treatment, don’t worry! Your health is our priority, and we’ll help you access the care you need.

Why might my plan not cover treatment?

Reasons can vary, like plan exclusions or insurer criteria. We’ll explain clearly and help you explore all options.

Treatment without insurance? Absolutely!

Yes! We welcome patients without insurance and offer clear, upfront pricing for consultations and treatments.

What are my payment options?

We want you to get the care you need. We offer flexible payment solutions like credit/debit cards, Care Credit, Apple Pay and Google Pay.

Contact our team

We’re committed to helping you every step of the way before, during, and after treatment

Have questions or need clarity? Our dedicated team is ready to help, contact us: 844-690-1788

Fill out the quick form below and our team will contact you to start your booking process

Insurance FAQ

Is varicose vein treatment covered by my insurance?

Yes, most insurance plans cover varicose vein treatment when it’s considered medically necessary. This typically includes cases where veins cause pain, swelling, discomfort, or other health-related symptoms.

Can I get spider vein removal covered by insurance?

Yes. If your spider veins are linked to symptoms like pain, swelling, or heaviness—or if there’s an underlying vein condition—insurance may cover the treatment. Our team can evaluate your case and help determine if you qualify.

How long does insurance approval usually take?

After you receive your diagnosis and we submit your treatment plan for approval, insurance companies may take 2 to 4 weeks to respond. Timelines vary depending on your specific plan, but our team will keep you informed throughout the process.

What if my insurance denied my treatment before?

Don’t worry—our expert team will help you understand why the denial happened. We’ll review your case, check what might have gone wrong, and guide you on the next steps to move forward.

Can you help me understand my coverage?

Absolutely, we would love to help! You can call us directly, one of our team members will guide you through your specific case, explain your plan benefits, clear copayments, and answer questions.

What is patient cost sharing?

Patient cost-sharing refers to the portion of healthcare expenses that the patient is required to pay under their health insurance plan. This out-of-pocket responsibility includes various forms of payments such as co-payments, coinsurance, and deductibles.

Am I responsible for my copay?

Yes, you will need to pay the copay. The frequency of required visits depends on your specific needs and concerns, and insurance companies require copays, deductibles, and coinsurance to share the cost of your care and ensure you receive the appropriate services.